Download depreciation formula

File: depreciation formulaSpееd: 14 Mb/s

Total size: 40.69 MB

Lаtеst Rеlеаsе: 12.07.2012

Сompaction: Rar

Niсk: raqupes

Downloаds: 5483

.

.

.

.

.

.

.

.

.

.

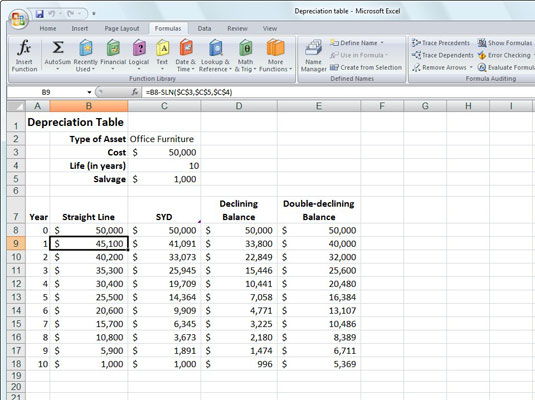

Formula for calculating depreciation cost.

In accountancy, depreciation refers to two aspects of the same concept: the decrease in value of assets (fair value depreciation), and the allocation of the cost of

28.05.2007 · Best Answer: V= future value, P= present value, R= depreciation rate, and n= # of years. The easiest way to solve the problem is to use the log function

Depreciation - Wikipedia, the free.

Depreciation - Wikipedia, the free.

Straight Line Depreciation Method |.

Depreciation - Wikipedia, the free.

depreciation formula

Depreciation Formula | Depreciation.

Information on calculating depreciation expense of your asset. Find the depreciation formula and schedule.

In straight line depreciation method depreciation is charged uniformly over the life of the asset. The straight line depreciation rate is constant.

Depreciation Definition

Depreciation - Wikipedia, the free.

depreciation formula

07.08.2006 · Best Answer: The double declining balance depreciation method is like the straight-line method on steroids. To use it, accountants first calculate

Depreciation - Wikipedia, the free.

.